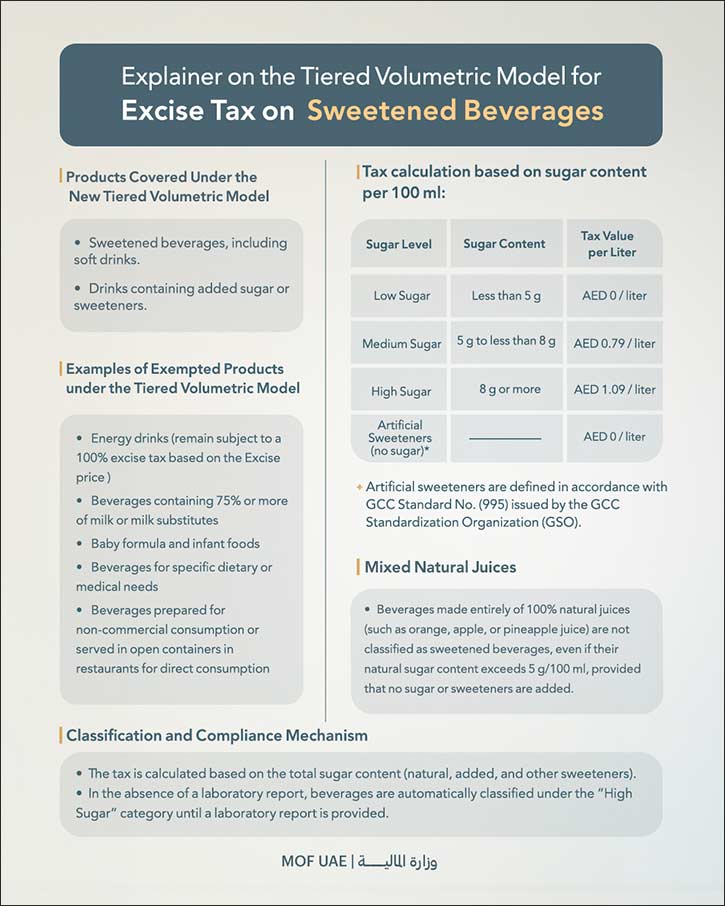

Amendments to take effect on January 1, 2026 Abu Dhabi, December 11, 2025 The Ministry of Finance has announced the issuance of Cabinet Decision No. (197) of 2025 on selective goods, the tax rates or amounts imposed on them, and the method for calculating the selective price. The resolution introduces amendments to the excise tax with the aim of implementing the “tiered volumetric model” on sweetened beverages. The new decision will replace Cabinet Resolution No. (52) of 2019 on Excise Goods and their applicable tax rates, along with its subsequent amendments. The amendment is part of the UAE’s ongoing efforts to promote public health and encourage healthier consumption habits across the community, in line with the recent amendments to Federal Decree-Law No. (7) of 2025 on Excise Tax. It aims to establish a unified legislative framework that clearly defines excise goods and their applicable tax rates and values, making it easier for all taxable persons to understand, comply with, and fulfill their obligations. Tax Calculation Method The resolution introduces a tiered excise tax system for sweetened beverages, with the tax rate determined by the sugar content per 100 milliliters. Under the new model, beverages containing 5 grams or more but less than 8 grams of sugar per 100 milliliters will be taxed at AED 0.79 per liter, while those containing 8 grams or more of sugar per 100 milliliters will be subject to a tax of AED 1.09 per liter. Beverages with less than 5 grams of sugar per 100 milliliters, as well as those containing only artificial sweeteners, will be exempt from taxation. The resolution also outlines the Federal Tax Authority’s procedures for classifying products, including their addition to the official price list, as well as the steps to be taken when taxable persons fail to submit the required laboratory reports or supporting documentation. In such cases, the tax shall be applied according to the highest sugar content category and may later be revised upon submission of an approved laboratory report. All amendments related to the tiered volumetric model will take effect for all taxable persons on January 1, 2026. The Ministry of Finance emphasised that these amendments align with the government’s commitment to promoting public health and reducing the financial burdens associated with diseases linked to excessive sugar consumption, while also establishing a clear and unified framework for the application of the excise tax, one that supports both consumers and investors.

|