Ministry of Finance and Federal Tax Authority Launch Initiative to Waive Late Registration Penalties under the Corporate Tax Law

UAE, April 29, 2025

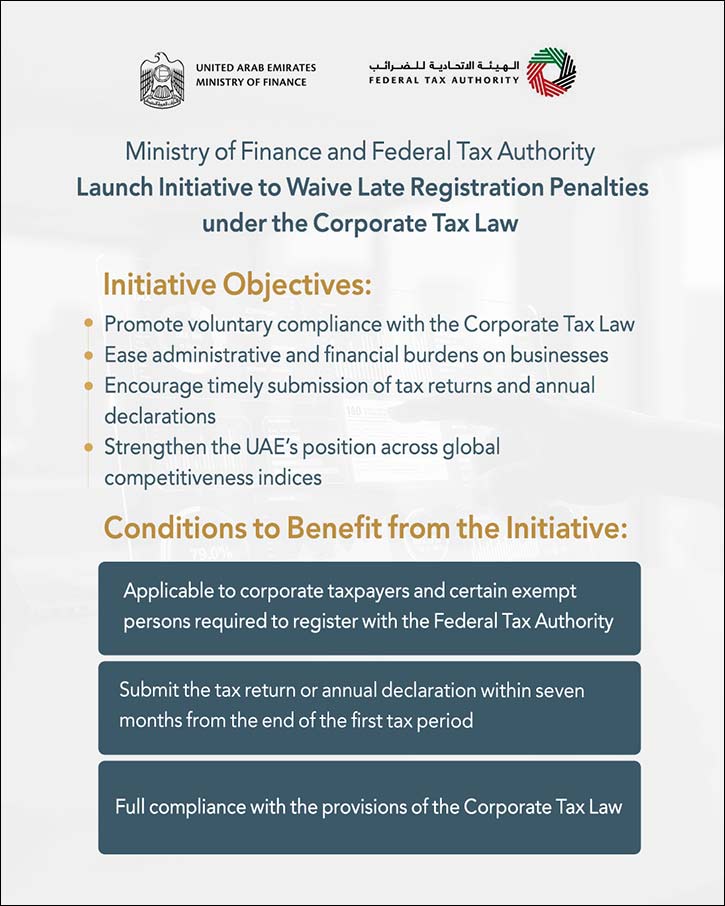

The Ministry of Finance (MoF) and the Federal Tax Authority (FTA) have announced the issuance of a Cabinet Decision launching an initiative to waive administrative penalties for corporate taxpayers and certain exempt persons who failed to submit their tax registration applications with the FTA within the required timeframe.

To qualify, eligible parties must file their tax return or annual statements within a period not exceeding seven (7) months from the end of their first tax period, as stipulated under the Corporate Tax Law.

The Cabinet’s decision reflects the proactive approach of the Ministry of Finance and the Federal Tax Authority to enhance tax compliance. It aims to encourage registrants to file tax returns or annual statements before the deadline, bolstering early compliance with legal requirements.

Additionally, the FTA confirmed that necessary procedures will be implemented to refund administrative fines collected from those who meet the specified criteria.

The initiative reaffirms the continued commitment of the Ministry of Finance and the Federal Tax Authority to enhancing the tax compliance environment in the UAE, facilitating procedures, and easing financial burdens on businesses. It aims to enable taxpayers to meet their obligations smoothly and benefit from the exemptions, provided they file their tax returns or annual declarations within the prescribed timeframe.

The decision is expected to significantly support the UAE’s ongoing effort to ensure better compliance during the first year of corporate tax implementation.

It underscores the government’s commitment to supporting national businesses by providing incentives that encourage voluntary compliance, reduce administrative and financial burdens associated with tax registration, and further strengthen the UAE’s standing across global competitiveness indices.

ShareHome >> Local News and Government Section

Return to Ritual: Celebrate Self-Care Month with BUFARMA Skincare

Rediscover family shopping days: REDTAG opens its doors in Al Ain

Dubai Culture Launches Open Call for 14th Sikka Art & Design Festival

Summer Restaurant Week Returns This DSS with Over 65 Exclusive Dining Deals Across Dubai

Julien Calloud Appointed CEO of SAVOYE to Lead a New Era of Performance and Innovation

Zoho Powers Up CRM for Everyone Platform with AI to Elevate Customer Experience

Media's Role in the Age of Algorithms By HH Sheikha Latifa bint Mohammed bin Rashid Al Maktoum

VinFast VF 8: The Premium Electric SUV Empowering a New Generation of Entrepreneurs in the UAE

Enter the Jurassic Era at VOX Cinemas

NYUAD Researchers Find Link Between Brain Growth and Mental Health Disorders

Emirates reit reports a strong Q1 2025 with 24% increase in property income

Dubai Land Department encourages Emirati citizens to join the Dubai Real Estate Broker Programme

Tabreed and CVC DIF to acquire Abu Dhabi's PAL Cooling from Multiply Group

UAE Team Emirates-XRG take home five National Championship victories

Porsche Centre Abu Dhabi & Al Ain Leads Region with First Manthey Kit Installation on 911 GT3 RS